[section separator="true"]

[section-item 9]

[row]

[column 12]

[toc-this]

Definitions

Transactions (or parts thereof) and/or actions linked to them which have not been carried out in accordance with the legal and regulatory provisions applicable are considered as errors.

When [link title="testing%20controls" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FExamination%2FTests-of-controls.aspx" /]

, an error is a control deviation and the total errors are expressed as a rate of deviation or frequency of deviation.

When performing [link title="substantive%20tests%20of%20details" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FExamination%2FTests-of-details.aspx" /]

, an error is a non-compliance. Extrapolated rate of error is the auditor’s best estimate of error in the population.

Instructions

Results of tests in general

Once the audit tests are performed, the auditor should review all errors identified and consider whether the audit evidence enables the auditor to reach an appropriate conclusion about the population for each audit test.

The auditor should evaluate whether the errors found are [link title="material" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FPlanning%2FMateriality.aspx" /]

, individually or in aggregate.

In all circumstances, the auditor should investigate the nature and cause of errors identified and their possible effect on the objective of the particular audit procedure and on other areas of the audit.

Some errors may have a common feature, e.g. type of transaction, location, or time period. In such circumstances, the auditor may decide to identify those items in the population that possess the common feature, and extend audit procedures in that stratum.

In extremely rare circumstances, a non-compliance may be an anomaly (i.e. demonstrably not representative of non-compliances in the population). For a non-compliance to be considered as an anomaly, the auditor should have a high degree of certainty that it is not representative of the population. The auditor obtains this certainty by performing additional audit procedures to obtain sufficient appropriate audit evidence that the error does not affect the remainder of the population.

Three scenarios are possible with regard to the rate of deviation or extrapolated rate of error resulting from the audit tests and interpretation thereof:

|

The rate of deviation (tests of controls) or extrapolated rate of error plus known error(s) (tests of details):

|

Interpretation

|

|

is below the materiality threshold set by the auditor.

|

- the controls can thus be relied upon

- the assertions are deemed to have been satisfied

|

|

is less than but close to the materiality threshold.

|

- the auditor considers the persuasiveness of sample results in light of other audit procedures, and may obtain additional audit evidence

|

|

exceeds the materiality threshold set by the auditor.

|

- controls are assessed as not operating effectively

- the assertions are not satisfied, and thus there is a risk of material non-compliance

|

Results of tests of controls

Reliance on controls

Where the auditor has decided to rely on [link title="internal%20controls" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FPlanning%2FDesigning-audit-procedures.aspx%23Audit%20approach" /]

and has designed the audit approach accordingly, the objective of [link title="testing%20controls" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FExamination%2FTests-of-controls.aspx" /]

is to confirm the extent of reliance on these controls.

The auditor should evaluate the results of controls testing at the level of each individual key control in order to reach an overall assessment of the effectiveness of the controls. Evaluating the results of controls testing requires a high degree of professional judgement as they have an impact on the audit approach. An unexpectedly high sample error rate in the tests of controls may lead to an increase in the assessed risk of material non-compliance, unless further audit evidence substantiating the initial assessment is obtained.

The auditor should also assess whether management has detected the errors and the response and remedial actions they have taken to address them.

The results of tests of controls may be as follows:

- if, when testing the controls, the auditor has ensured that they are operating effectively and continuously throughout the period, then (s)he will maintain the audit approach adopted at the planning stage;

- if some weaknesses are noted, but the overall system is not considered unreliable, then the assessment of control risk is revised and the extent of

[link title="substantive%20procedures" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FExamination%2FSubstantive-procedures.aspx" /]

is increased in accordance with the [link title="assurance%20model" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FPlanning%2FAssurance-model.aspx" /]

;

- if the controls are not operating as they should, then no assurance can be obtained regarding compliance with applicable laws and regulations. The auditor should then obtain the audit evidence mainly or solely from substantive testing.

Effectiveness of controls

Another separate objective may be to report on the effectiveness of internal controls, in which case the assessment of controls may be effective, partially effective or not effective, respectively.

Assessment of the performance of the internal controls must be corroborated by substantive testing.

Extrapolation of errors

In Statement of Assurance audits no explicit extrapolation of errors is necessary for tests of controls, since the sample rate of deviation is also the extrapolated rate of deviation for the population as a whole.

Results of tests of details

Analysing and classification of errors

Errors found when performing tests of details should be accurately recorded, especially when testing a statistical [link title="sample" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FPlanning%2FAudit-sampling.aspx" /]

, so that the audit results can be extrapolated.

Nature and cause of the error should be analysed in a step-by-step process in order to determine whether and to what extent they are relevant for inclusion in the audit conclusion or opinion.

Nature

The auditor should establish whether the error affects conditions of payment directly. It can be due to

- non-compliance with eligibility rules

- occurrence (e.g. expenditure has not been actually incurred or is not supported by appropriate justifying documentation or probative value)

- accuracy (e.g. the eligible expenditure has been incorrectly calculated)

Errors indirectly affecting the conditions of payment (e.g delay in payment, absence of non-essential documents) are classified as other compliance issue.

Cause

The error may be caused by the following reasons which may appear individually or in any combination:

The consideration of the causes of errors can facilitate the drafting of clear and cost-effective [link title="recommendations" link="%2Faware%2FGAP%2FPages%2FRecommendations.aspx" /]

.

When errors result from management override of a control, the auditor should question the preliminary [link title="assessment%20of%20internal%20controls" link="%2Faware%2FGAP%2FPages%2FCA-FA%2FPlanning%2FInternal-control.aspx" /]

.

Other considerations

The auditor should further establish whether the error is

Errors that are detected and corrected on the initiative of the managing body before the closure of the accounts for the financial year and independently of the checks carried out by the ECA, are not taken into account in the [a-glossary term="Statement%20of%20Assurance"]Statement of Assurance[/a-glossary]

legality and regularity audits, since they demonstrate the efficient working of the internal controls and no longer affect the accounts of the financial year.

The auditor may have to consider how to report errors that have been identified and which may not be quantitatively material, as the [a-glossary term="Discharge%20authority"]discharge authority[/a-glossary]

may have an interest in being informed about non-compliance in certain sensitive areas.

Quantification of errors

The percentage and the monetary value of the quantifiable error discovered should be calculated in relation to the recorded value of the transaction at the level concerned.

The quantification of the error concerns the EU contribution; in cases of co-financing (mainly with the member states), a distinction is made between the proportion financed by the EU and the proportion financed by third parties.

Quantification depends on a comparison between the actual value of the transaction and the value if it had been conducted in accordance with applicable provisions. The difference thus calculated is expressed as a percentage underestimation or overestimation of the value of the transaction recorded.

ECA applies a threshold for quantifiable errors of 1 %.

Known errors

Errors identified during supplementary work outside the scope of representative samples are to be considered as “known errors". These errors are only taken into account if they relate to transactions covered by the audit scope (audit population). They are not projected to the entire population, but are taken into consideration on the basis of the absolute amounts (de minimis threshold for reporting known errors is €10 000).

Evaluation and extrapolation

The auditor should evaluate the sample results, by comparing the extrapolated error rate/amount to the tolerable error rate/amount (amount of immaterial error), in order to determine whether his/her assessment of the relevant characteristic of the population is confirmed or needs to be revised (e.g. if the auditor has found an unexpectedly high error amount). Based on the evaluation of the results, auditors may need to extend their audit procedures and/or carry out additional procedures.

The errors can only be extrapolated if the selection procedure resulted in a representative sample.

The auditor should extrapolate all monetary errors found in the sample to the population and consider the effect of the extrapolated error on the particular audit objective and on other areas of the audit.

For non-statistical samples, the auditor should make a judgement about the likely non-compliance in the population.

When an error is considered an [link title="anomaly" link="%23Anomaly" /]

, it may be excluded from extrapolation. However, its effect, if uncorrected, still needs to be considered in addition to the extrapolation of the non-anomalous errors.

Evaluating the overall results of tests of details requires professional judgement, as the auditor should understand the nature and cause of the errors and consider both the quantitative aspects and the qualitative aspects of errors in order to reach a conclusion .

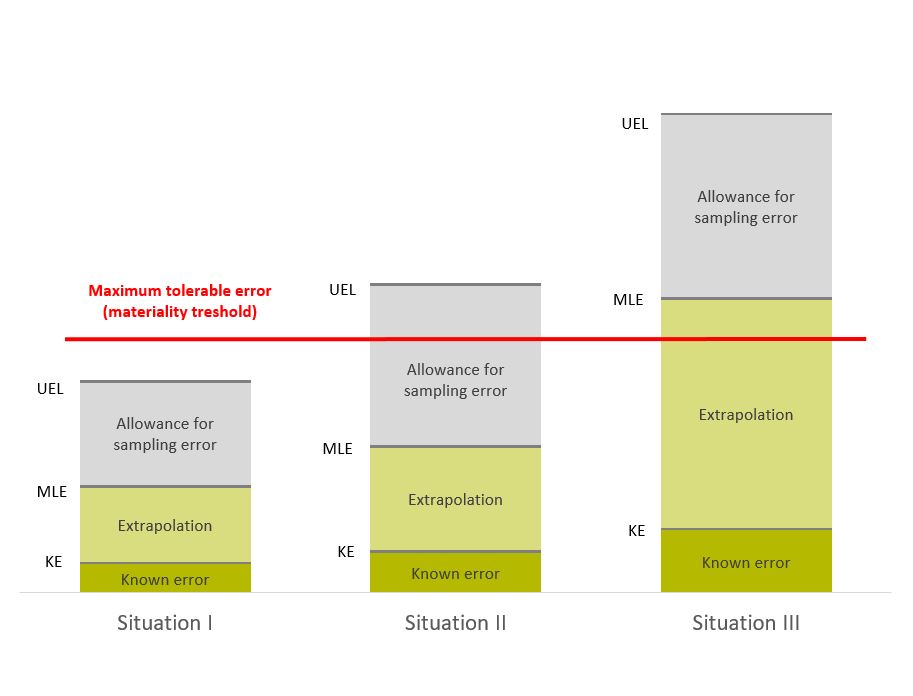

The extrapolation and evaluation of the results of substantive tests of details can be represented as follows:

(UEL - Upper Error Limit MLE - Most Likely Error KE - Known Error)

Conclusions to be drawn

Situation I: The upper error limit and the most likely error are less than the materiality threshold. This is a clear result.

Situation II: The upper error limit exceeds the materiality threshold but the most likely error is lower than the materiality threshold. This is a result, for which the auditor should consider:

- requesting the audited entity to investigate the deviations;

- carrying out further testing; and

- using alternative audit procedures to obtain additional assurance.

Situation III: The most likely error exceeds the materiality threshold error. As the lower error limit is below the materiality threshold, the auditor should consider:

- requesting the audited entity to investigate the deviations;

- carrying out further testing; and

- using alternative audit procedures to obtain additional assurance

The lower error limit can be either below or above the sum of known errors. Therefore, it is not shown in the diagram.

Situation IV (not shown in the diagram): The lower error limit and the most likely error exceed the materiality threshold. This is a clear result requiring no further consideration.

In practice, timing constraints mean that ECA is usually obliged to use the third of these possibilities – alternative audit procedures providing additional assurance – to obtain additional assurance.

Resources

[icons-list icon-size="2" separator="line" icon-vertical-alignment="middle" vertical-alignment="middle"]

[icon-list-item title="Quantification%20of%20public%20procurement%20errors" link="%2faware%2FDocuments%2FQuantification-of-public-procurement-errors.pdf" icon="file-word-o" linking="new-window" /]

[/icons-list]

[/toc-this]

[/column]

[/row]

[/section-item]

[section-item 3]

[row]

[column 12]

[panel panel-style="boxed" title="Related%20documents" icon="book" class="ref-panel"]

[standards]

[link new-window title="ISSAI%20400%2F58" link="https%3a%2f%2fwww.issai.org%2fwp-content%2fuploads%2f2019%2f08%2fISSAI-400-Compliance-Audit-Principles-1.pdf%23page%3D26" /]

[link new-window title="ISSAI%204000" link="https%3a%2f%2fwww.issai.org%2fwp-content%2fuploads%2f2019%2f08%2fISSAI-4000-Compliance-Audit-Standard.pdf" /]

[link new-window title="ISA%20450" link="https%3a%2f%2fwww.ifac.org%2fsystem%2ffiles%2fpublications%2ffiles%2fIAASB-2020-Handbook-Volume-1.pdf%23INTERNATIONAL%2520STANDARD%2520ON%2520AUDITING%2520450" /]

[link new-window title="ISA%20530" link="https%3a%2f%2fwww.ifac.org%2fsystem%2ffiles%2fpublications%2ffiles%2fIAASB-2020-Handbook-Volume-1.pdf%23INTERNATIONAL%2520STANDARD%2520ON%2520AUDITING%2520530" /]

[/standards]

[/panel]

[/column]

[/row]

[row]

[column 12][/column]

[/row]

[row]

[column 12]

[toc fixed="true" selectors="h2%2Ch3" class="basic-toc" /]

[/column]

[/row]

[/section-item]

[/section]